Form Ct-W4 2025. (effective january 1, 2025) less than or equal to greater than a b c $76 $942. If too little is withheld, you will generally owe tax when you file your tax return.

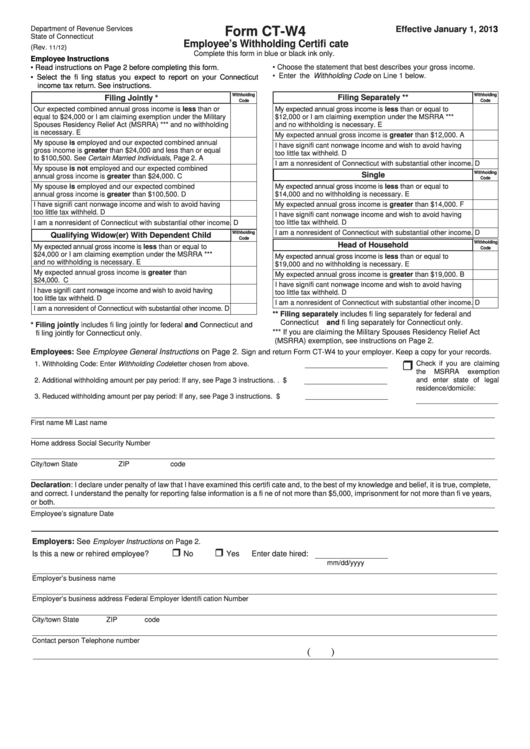

Tax rates used in the withholding. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut.

Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut.

Ct w4 Fill out & sign online DocHub, Effective january 1, 2025, the first $10,000 ($20,000 for married filing joint) will be taxed at 2%, down from 3%, the next $40,000 ($80,000 for married filing joint) will. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut.

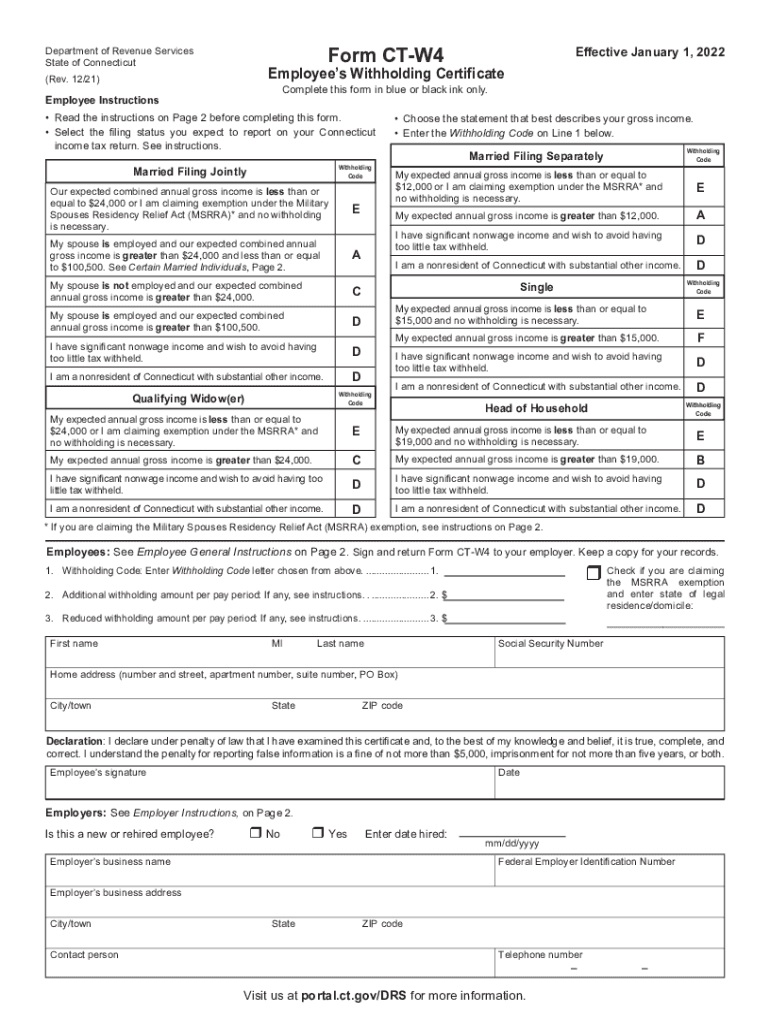

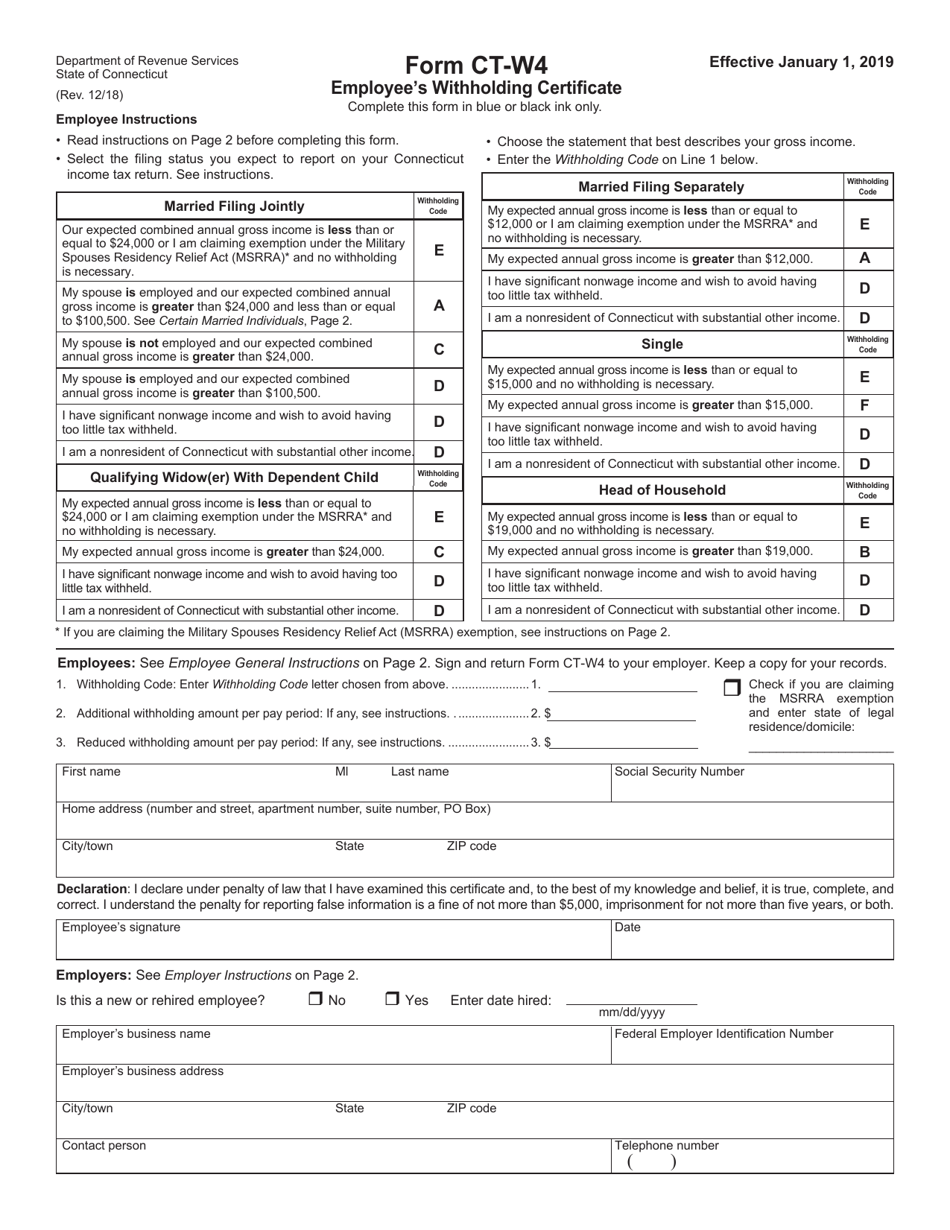

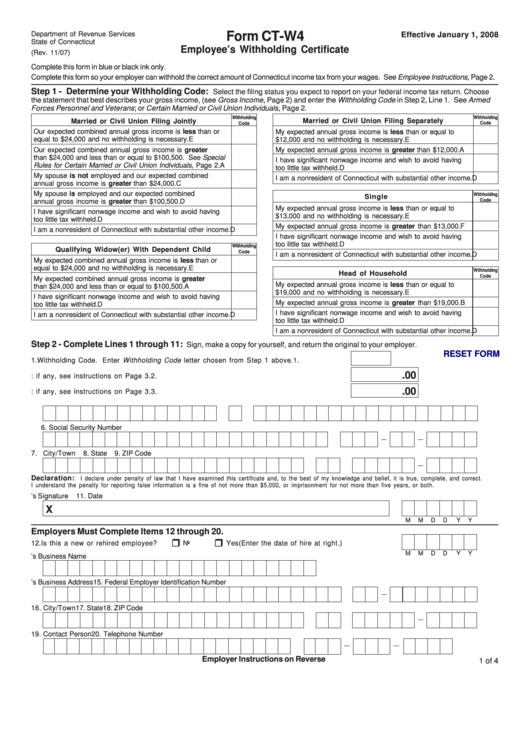

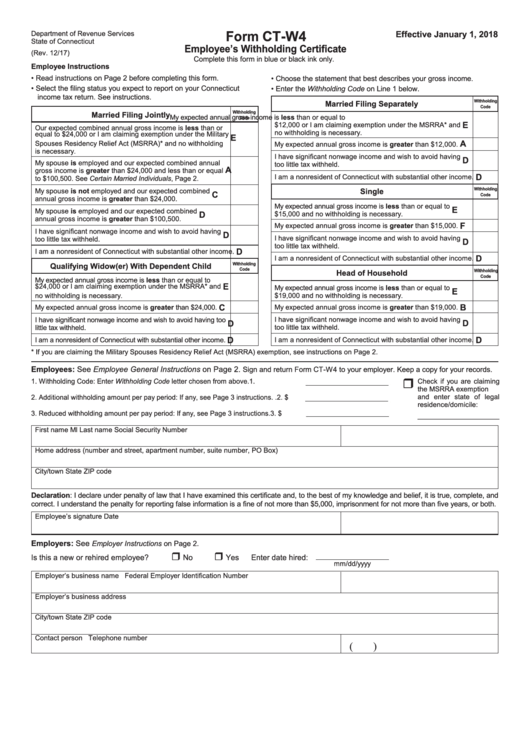

Form CTW4 Fill Out, Sign Online and Download Printable PDF, Effective january 1, 2025, the first $10,000 ($20,000 for married filing joint) will be taxed at 2%, down from 3%, the next $40,000 ($80,000 for married filing joint) will. Fill out the employee's withholding.

Ct w4 Fill out & sign online DocHub, If too little is withheld, you will generally owe tax when you file. Connecticut’s 2025 withholding methods are unchanged from 2025, the state department of revenue services said dec.

Fillable Form CtW4 Employee'S Withholding Certificate printable pdf, Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. 12/22) effective january1, 2025 employee instructions • read the.

Form CtW4 Employee'S Withholding Certificate printable pdf download, If too little is withheld, you will generally owe tax when you file your tax return. Tax rates used in the withholding.

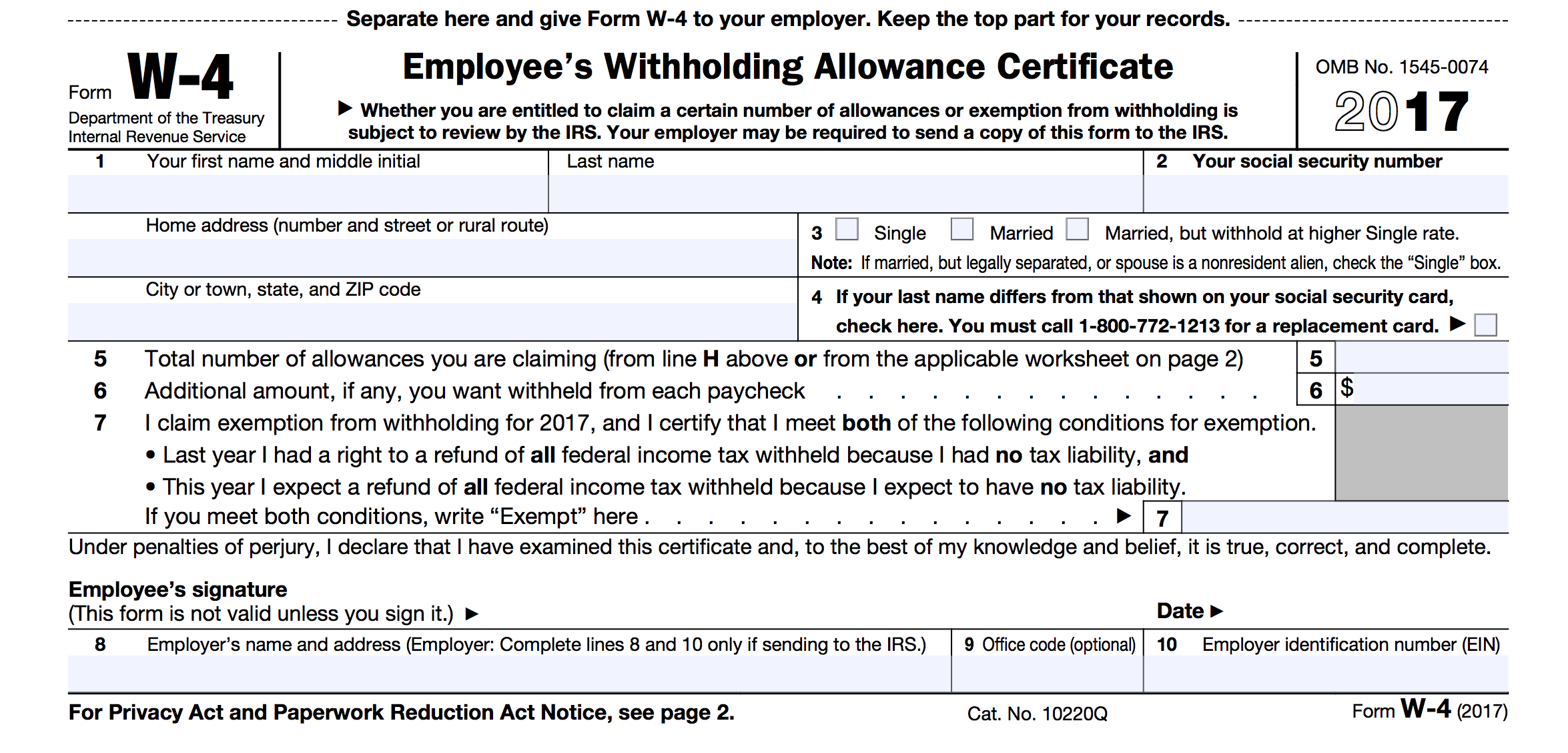

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Tax rates used in the withholding. Fill out the employee's withholding.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Tax rates used in the withholding. If too little is withheld, you will generally owe tax when you file.

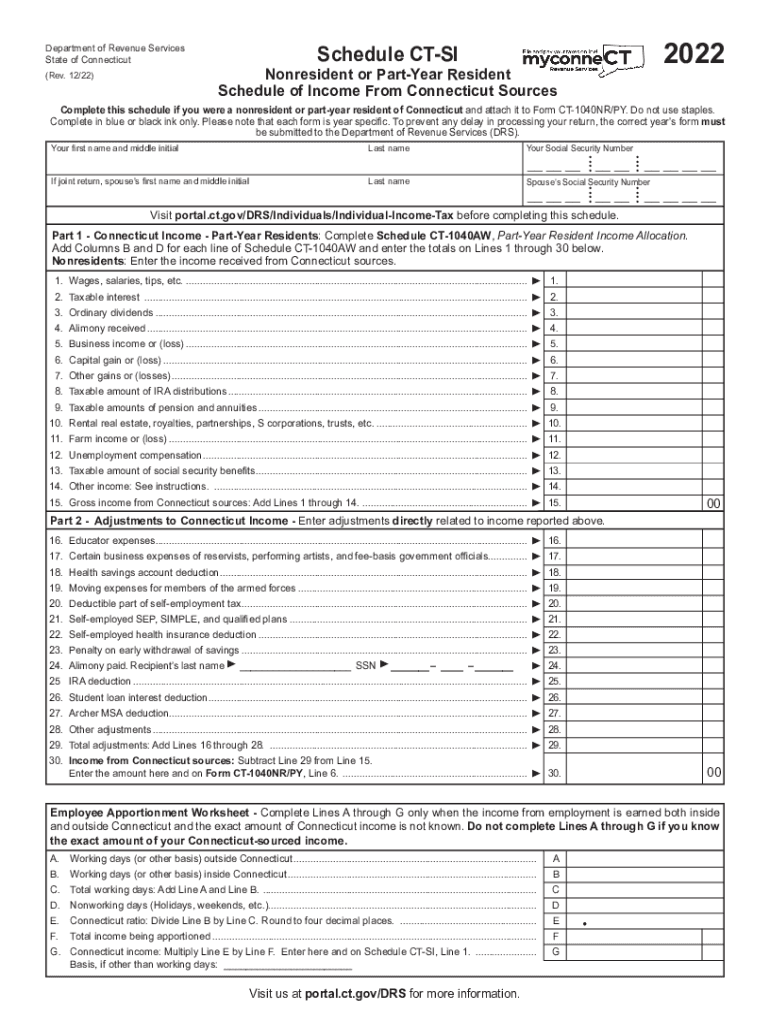

Ct Si 20222024 Form Fill Out and Sign Printable PDF Template signNow, Effective january 1, 2025, the first $10,000 ($20,000 for married filing joint) will be taxed at 2%, down from 3%, the next $40,000 ($80,000 for married filing joint) will. Fill out the employee's withholding.

Form CtW4 Employee'S Withholding Certificate printable pdf download, Fill out the employee's withholding. Withholding form, means form ct‑w4, employee’s withholding certificate or form ct‑w4p, withholding certificate for pension or annuity payments.

W 4 Form Printable Version 2025 W4 Form, (effective january 1, 2025) less than or equal to greater than a b c $76 $942. Effective january 1, 2025, the first $10,000 ($20,000 for married filing joint) will be taxed at 2%, down from 3%, the next $40,000 ($80,000 for married filing joint) will.

Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut.